Has OpenAI's Moment of Truth Arrived?

How increased competition is changing the solution field, and why marketers should care.

The hot air balloon ride may be over for OpenAI.

Several critical AI product announcements and rollouts over the past several weeks have jeopardized OpenAI’s dominant hold on the GPT writing marketplace. This is true from a qualitative offering and a larger market share perspective. OpenAI’s often confusing PR strategy and legal quandaries further complicate matters.

Enterprises and their sales and marketing departments suddenly have more options. Solutions from Anthropic, Google, Microsoft, Mistral, Perplexity, and Writer, to name just a few, offer safer and more accessible generative writing tools for individual contributors and better algorithms for enterprise-grade deployments.

As a result, sales and marketing leaders should consider which tools to adopt beyond the OpenAI suite of GPT families. The remainder of this article will examine several critical weak points for OpenAI, enterprises' alternatives, and a few thoughts on how the AI writer market could evolve. Finally, we close with what OpenAI needs to consider to respond effectively and meet the competitive moment.

Visit CognitivePath today, and learn more about our advisory services!

Writers for the Enterprise

Writer CEO MayHabib detailed the company’s enterprise strategy in a recent Scaling AI podcast.

CognitivePath is closely monitoring the generative writing marketplace, and we have seen several alternatives surpass the ChatGPT Enterprise offering. ChatGPT Enterprise suffers from what we deem to be weak product development. In essence, we see ChatGPT Enterprise and the lesser ChatGPT Teams as versions of a product built for consumers with security measures, ethical data usage guarantees, and per-seat pricing bolted on to make them “safe” for enterprise use.

In the past few weeks, both Microsoft Office and Google Workspace have added GPT4 and Gemini capabilities to their full gamut of offerings. Whether for the most professional and secure grades of these products or the individual contributor and their personal license, business users can access these tools in native office applications with the same security guardrails they expect.

The security measures that two of the three biggest cloud providers offer the enterprise cannot be underestimated. For example, an enterprise. Office with Copilot implementation is provisioned by Microsoft Azure identity management software. That makes adoption very easy for companies that want to provide access to writer tools for productivity but are leery of data leaks and security risks via the supposedly safe web-based OpenAI business products.

We have been testing Office Copilot, Microsoft’s flavor of GPT 4, over the past couple of days. The productivity gains from working directly in the app rendered our limited use of ChatGPT useless. It was easier, safer, and more secure to use CoPilot. Google offers a similar integration for Gemini.

In addition to the two leading office productivity suites, it is apparent that Writer, an enterprise writing startup using its own LLM model, Palymyra, is making significant headway with its enterprise sales. We use Writer and find the qualitative output better than GPT 4. Its use cases tailored to enterprise sales and marketing job functions are superior.

We do think marketers should not just consider the ease of Microsoft and Google adoption but also Writer as an application that’s been built to specifically meet the writing use cases of an enterprise, including sales and marketing, with all of the security and privacy measures needed to implement. This differs significantly from OpenAI, which suffers from meandering product vision across several categories and dramatic, sometimes unrelated PR moments, which are more likely to trend on X than win enterprise sales with the C suite.

Writer offers several critical integrations and API access to make it more helpful to enterprises. One could argue that Writer’s success is its proprietary LLM and unrelenting singular focus on creating excellent writing technology for the enterprise. That makes it stand out from other writing startups like marketing-focused Jasper and Copy.ai, which license GPT. We spoke briefly with May Habib, CEO of Writer at MAICON, and we have a standing invite for her to appear on the No Brainer podcast.

The big enterprise writing app questions moving forward for OpenAI and one for Writer are:

Can it better integrate into enterprise office applications and CRMs?

Will they offer vertical-specific solutions to address specific job roles or industries?

Can they add more AI guardrails to make their offering safer?

Can Writer’s sales and marketing efforts match Grammarly’s effectiveness and become a go-to, must-have business-only productivity app?

Models for Enterprise Applications

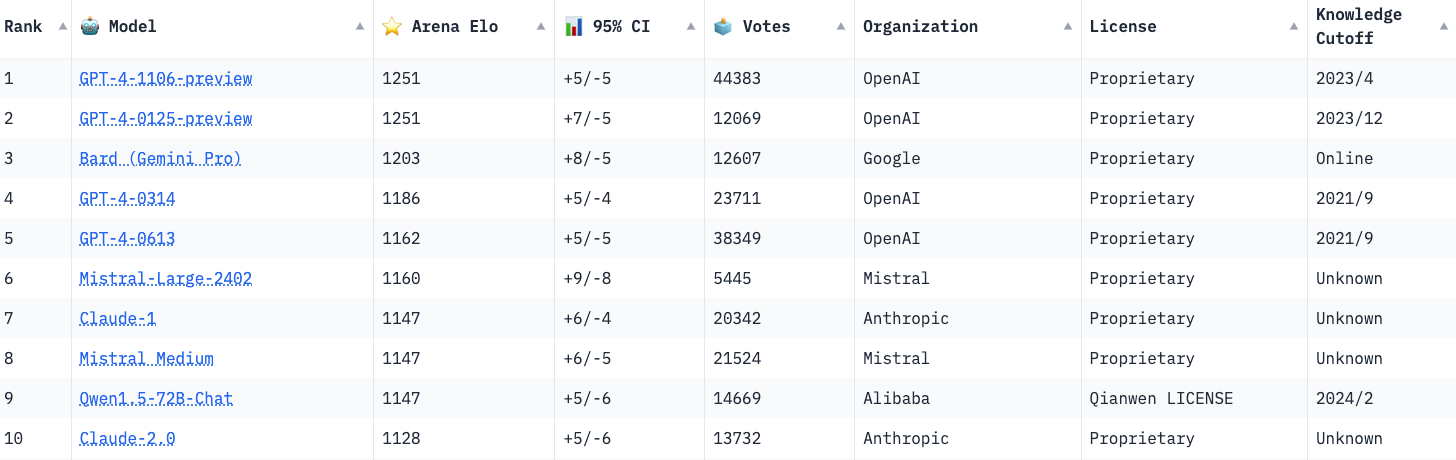

The Hugging Face LMSYs Chatbot Arena Leaderboard as of March 6, 2024.

Enterprises looking to license GPT for private applications may feel that few GPT competitors stand compared to GPT 4. Good news! The gap between OpenAI and the competition has closed in recent months, offering enterprise developers and their professional services partners a host of open-source and closed algorithm alternatives that effectively compete with GPT 4.

Much of the hype cycle of late has revolved around the releases of new LLMs, most notably Anthropic’s Claude 3, Google Gemini, and Mistral. Claude 3 has yet to debut on the ELO leaderboard for best chatbot, but Gemini Pro and Mistral rank as competitive with OpenAI’s GPT 4, which is still holding a slight lead. Early reviews have Claude 3 ranking ahead of GPT 4 in most instances. Depending on the configuration, these competitors' hosting costs can be lower than GPT 4.

More powerful competitors jeopardize OpenAI, which is, at its heart, a B2B provider of AI algorithms for developers. The number of GPT licenses for development cannot even be counted. One could argue that if OpenAI focused solely on this market, like NVIDIA’s focus on the AI chip market, it would dominate and perhaps even become somewhat unbeatable.

GPT-4 is Microsoft’s core writing technology for Azure customers and is resold by just about every other Cloud provider, with the notable exception of Google, which does allow licensing through partners like Jasper. Selling GPT algorithms to other developers is OpenAI’s core business.

GPT is also the primary driver behind OpenAI's relationship with Microsoft and its dominant Azure offering. With Microsoft’s recent addition of Mistral algorithms and last year's decision to carry Meta Llama algorithms within the Azure cloud marketplace, OpenAI’s position is now less of a monopoly and at risk of erosion.

Any fracture in this relationship has to raise alarms as Microsoft is OpenAI’s primary funder to the tune of $13 billion. Worse, while less well known than the GPT algorithms Whisper (speech recognition), Dall.E (images), and the much-discussed and unavailable Sora, arguably depend on OpenAI’s dominant market position in the writer market to succeed.

There are significant questions here, including:

What will happen to OpenAI’s overall business if it loses its LLM algorithm leadership position with the GPT models?

Can OpenAI catch up with more competitive pricing and terms of service?

Will the next iteration of OpenAI successfully meet the competitive nature of Claude3, Mistral?

Can Anthropic, Google, and Mistral capitalize on the moment and seize market share?

Open Access: ChatGPT versus Claude 3, Gemini Online, Perplexity, Etc.

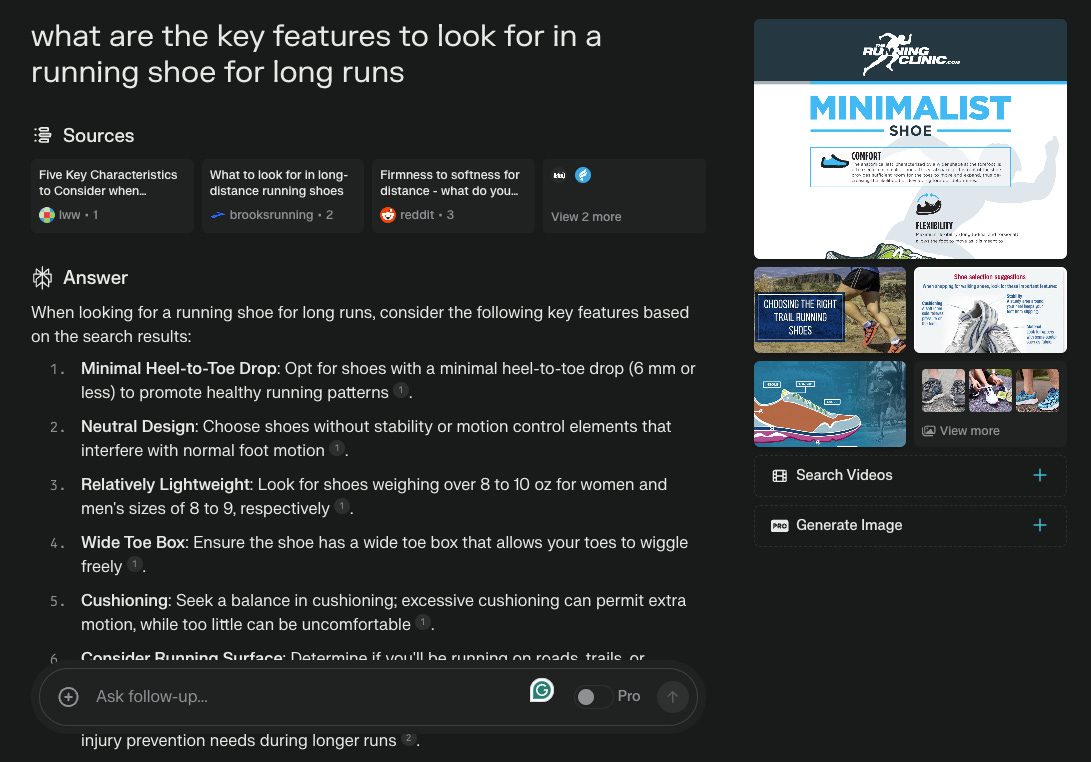

A Perplexity.AI search with sources.

Let’s be clear: OpenAI’s success is ChatGPT. But ChatGPT may be losing its shine as a web platform that is facing increased competition from every software vendor incorporating GPT or another algorithm into their apps, GoogleGemini via Google Search, and scores of online chatbots, including those fueled by competing algorithms like Claude and Perplexity.

According to SimilarWeb, ChatGPT’s traffic has flatlined in recent months and is down 11% overall from its peak. Mobile app growth has stagnated online. Why has the famed online tool flatlined despite the launch of vaunted GPT apps and “multimodal” Dall.E integration?

ChatGPT’s free version uses the lesser GPT 3.5 algorithm. While also offering a higher grade pro version, Anthropic’s Claude 3 Sonnet may be better than GPT 4, but using it is free! Gemini Pro is available via search, and its Gemini site is free. Perplexity, which leads its responses with linked sources, offers a robust free version ideal for those who want more substantial transparency (Google Gemini also offers sources).

The point is that competition has increased, and the novelty of ChatGPT as a wonder chat resource is gone. Like the early search market, ChatGPT may be the equivalent of Excite or Lycos, but it is just an early leader. Continuing the analogy, given its lack of growth, it certainly has not attained dominant Google search status.

With ChatGPT slowing down, OpenAI may need a new window to demonstrate its technological wares. Questions moving forward on the web application include:

Will OpenAI open the GPT store for public consumption to strengthen its offering?

Will GPT5 arrive this year, and if so, will the public version only get upgraded to version 4, or will we see a leapfrog ahead of the competitors?

If OpenAI launches a competitive search product, will it get bundled as part of the larger ChatGPT offering?

OpenAI’s Worst Enemy May Be OpenAI

The most recent No Brainer podcast on AI hype had a segment dedicated to OpenAI.

Early leaders often find challengers who want to take market share. The best companies rise to the occasion and maintain their leadership position. Can OpenAI meet the moment and emerge in the enterprise, B2B algorithm, and consumer marketplaces? It may need to resolve its own very human quarks to do so.

OpenAI’s dramatic PR approach, which seems to favor attention above all, questionable ethics that have resulted in innumerous lawsuits, and perhaps even more confusing product strategy with its gamut of B2B and consumer offerings create what appear to be many distractions. And then there is the oft-confusing nonprofit mission and very for-profit approach that keeps tripping the company up, from its Thanksgiving fire/re-hire of Sam Altman to the most recent very public Elon Musk lawsuit drama.

Whether there is a method to the madness or they are simply a fury flying through the AI sky with reckless care, these distractions could ground the company when it most needs to focus.

The areas where it needs to focus most are its product strategies and customer-centric marketing. Often, OpenAI’s announcements strike as moments of promise with vague promises of delivery, most recently typified by the well-reported Sora launch. Focus requires passing on attention seeking for simply delivering on committed value.

Questions facing OpenAI include:

Can the company resolve its nonprofit foundation and move into a customer-oriented future once and for all?

Will the company focus more on delivering competitive value to its wider range of customers with clear and real offerings?

Is Sam Altman capable of keeping the company’s PR machine laser-focused on its customer segments, or will the media limelight keep drawing him and the company like a moth to a flame?

Conclusion

Marketers who see OpenAI as the primary solution for their AI needs, from individual contributor tools to potential enterprise models, should, at a minimum, have a backup plan. The good news is there is now a crowded field of very competitive offerings. 2024 is starting to look like the year OpenAI comes back down to earth.